Practitioner Distribution Considerations in your COVAX Clinic Feasibility Planning

This article should be considered alongside the COVAX Feasibility Tool – download the latest version here: https://www.cubiko.com.au/blog/is-the-covid-19-vaccine-right-for-my-practice/ - developed in conjunction with Riwka Hagen from Medical Business Services and Chris Smeed from Cubiko.

For practice managers and owners, there is an almost overwhelming range of considerations when determining the viability of a potential Covid-19 vaccination (COVAX) clinic at your practice. Some of these factors are within your control, and some are much less so.

One factor that could be in your control is the service fee percentage (or economic equivalent) that the practice plans to charge its General Practitioners in your COVAX clinic. Moreover, it is a factor that can have a significant impact on the outcome of your feasibility planning.

In this article, I will touch on some of the points to consider when determining this key input to your COVAX clinic planning.

Firstly, can a practice charge a different percentage to GPs for specific services?

Like any commercial agreement, there is room to negotiate terms between contracted parties. Many practices already provide for differentiated service fee charges, which are usually based on the extent of practice-borne costs in the provision of the service. Examples include:

- Lower service fee for Nursing home services, Home visits, or other out of clinic work

- Higher (or even 100%) service fee for nurse-intensive or nurse-only items billed

- Differential percentages on weekends or after-hours services

- Lower service fees for GP-intensive services such as medical reports

And a COVAX clinic is no different – it has unique costs and thus unique drivers of viability, and so is absolutely in the category of “reasonable items to renegotiate a service fee” for. Of course, there are some overall ATO guidelines around reasonable retentions for medical professional services, and so please seek professional advice on any likely options that you are considering.

Elements of COVAX clinic income, per the recent Expression of Interest (EOI) process

Under the EOI, some of the relevant income drivers for practice viability are:

- A Practice Incentive Payment (PIP) for completed vaccinations, and other grant-like income. Whilst some practices do share PIP income with their GPs, it appears less commercial to do so in a COVAX clinic given the relatively narrow feasibility for practices under the current EOI;

- Different item funding for VR vs Non-VR GPs, and for Rural vs Metropolitan status;

- Different item funding for after hours vs. ordinary hours vaccinations;

- Different item funding for Dose 1 vs Dose 2; and

- Understanding that the Medicare items will permit administration of COVAX by nursing staff without direct involvement of the GP (unless clinically indicated)

The first step is to consider is the question of, “Will my GPs accept a higher service fee for the clinic at all”? An approach to this question is probably a blog article unto itself. However, if the answer is “yes”, the practice might also consider whether further differential percentages are relevant based on the type of vaccine service provided.

There is no ability to change the VR vs Non-VR, or Metropolitan vs Rural status of the practice and its practitioners, but you may want to consider differential service fee retentions for vaccinations provided after hours (after between 8pm and 8am weekdays; after 1pm on Saturdays; and all day Sundays), because:

- For some clinics, after hours cost metrics can be out of proportion with the higher level of funding afforded by the after hours items, so may be an opportunity to set a different service fee; and

- Practitioners may be less willing to reduce their service fee percentage where it affects their after-hours or weekend leisure time.

Setting differential percentages of billings for Dose 1 vs Dose 2 is also worth some consideration. However, it could be argued that the item number funding for Dose 1 vs Dose 2 is largely proportional with the differential costs of provision, and is not relevant to the impact on Practitioner leisure time.

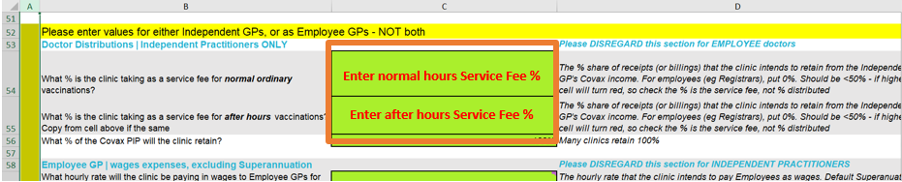

When you arrive at a percentage for the purposes of feasibility planning, use the COVAX feasibility tool to enter these percentages in Rows for after-hours vs in hours (cells C54 and C55 in Step 2 - see screenshot below). If you intend to keep the percentages the same, simply enter the same percentage in both cells. You may decide that it is best to not change any of these percentages relative to your current service fee retentions, but at least you have the option -and with the tool, you can understand the outcomes.

What about registrars or other employee practitioners?

The use of employee practitioners vs Independent Medical Practitioners (IMPs or “contractors”) will change the mix of COVAX clinic incomings vs outgoings, but will not greatly change the overall economics. That is to say, the clinic will still capture the “net” income effect of either the service fee (from IMPs), or the difference of income and wages (for employees)

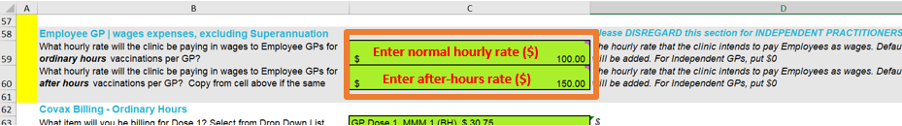

Even so, we thought it would be useful to include the option of employees in the COVAX Feasibility Tool for completeness and ease of use. For Employee GPs, enter 0% in cells C54 and C55 in Step 1 (same as in screenshot above), which will ensure all of their income is captured in the Practice Incomings. In cells C59 and C56 in Step 1 (see screenshot below), enter the Hourly rate dollar amounts that you estimate you will pay the employees, gross of tax but exclusive of Superannuation. The tool will apply default Superannuation rates.

Note the tool does not incorporate impacts of Payroll Tax expense for these employees (if applicable), workcover expenses, non-default superannuation, or other on-costs. As for any “on-costs” of either type of practitioner, ensure you include such costs in the model's administrative cost assumptions.

Taking the administration pain out of differential service fee percentages

Planning and administering a COVAX clinic will be painful enough – and so any changes to Service Fee retentions should be simple to manage throughout the vaccination program.

For Surgical Partners users, this is a simple process of changing the Practitioner settings in the Surgical Partners Hub. This could be done by setting a different % for the Medicare item codes pertaining to the COVAX program, or by setting up a new “Location” for the COVAX clinic in the Practice Management System (PMS), and configuring a differential percentage against that Location in the Hub.

Surgical Partners will automate the rest away, including the automatic inclusion of a separate line on the Practitioner statements, such that it is clear what their direct periodic return is from their participation in the clinic.

For practices not yet using Surgical Partners, probably the easiest method is to set up a different “Location” for the COVAX clinic, and simply apply the constant differential percentage to the report totals for the new clinic “Location”. In the event of different percentages for different item codes, this can be more complex. Of course, PMS Reports are available based on items (billed or receipted), and these could then be sifted through in a spreadsheet, to which the item-based differential percentages could be manually applied.

Bottom line - what suits your practice and its practitioners?

Every practice is different, especially in terms of existing contractual arrangements and informal relationship elements between a practice and its practitioners. And such relationships could be changed again in any discussion with practitioners around COVAX clinic feasibility. Ultimately, it will come down to the ability to engage with practitioners around a shared vision for COVAX clinic outcomes, and how contractual arrangements can be revisited in line with that vision, to the satisfaction of all parties.

In other words, it requires a negotiation process with the GPs, which is often easier said than done. Given its impact on COVAX clinic feasibility, it is a discussion that is at least worth having. Importantly, the ongoing administration of such changed arrangements need not be a burden on the practice.

Finally, practices need to understand that where GPs are practice owners too, it is likely that the non-requirement for a face-to-face attendance by the billing GP will result in such practices allocating COVAX activity to such owner GPs rather than associates if they are on site for any COVAX services. This may be a driver of associate readiness to negotiate a fair and equitable fee split to ensure all practitioners have the opportunity to participate in this important public health activity.

If you would like to discuss this further, reach out on either the COVAX Feasibility Model Facebook group, or directly to support@surgicalpartners.com.au